Corporate Tax Scenario

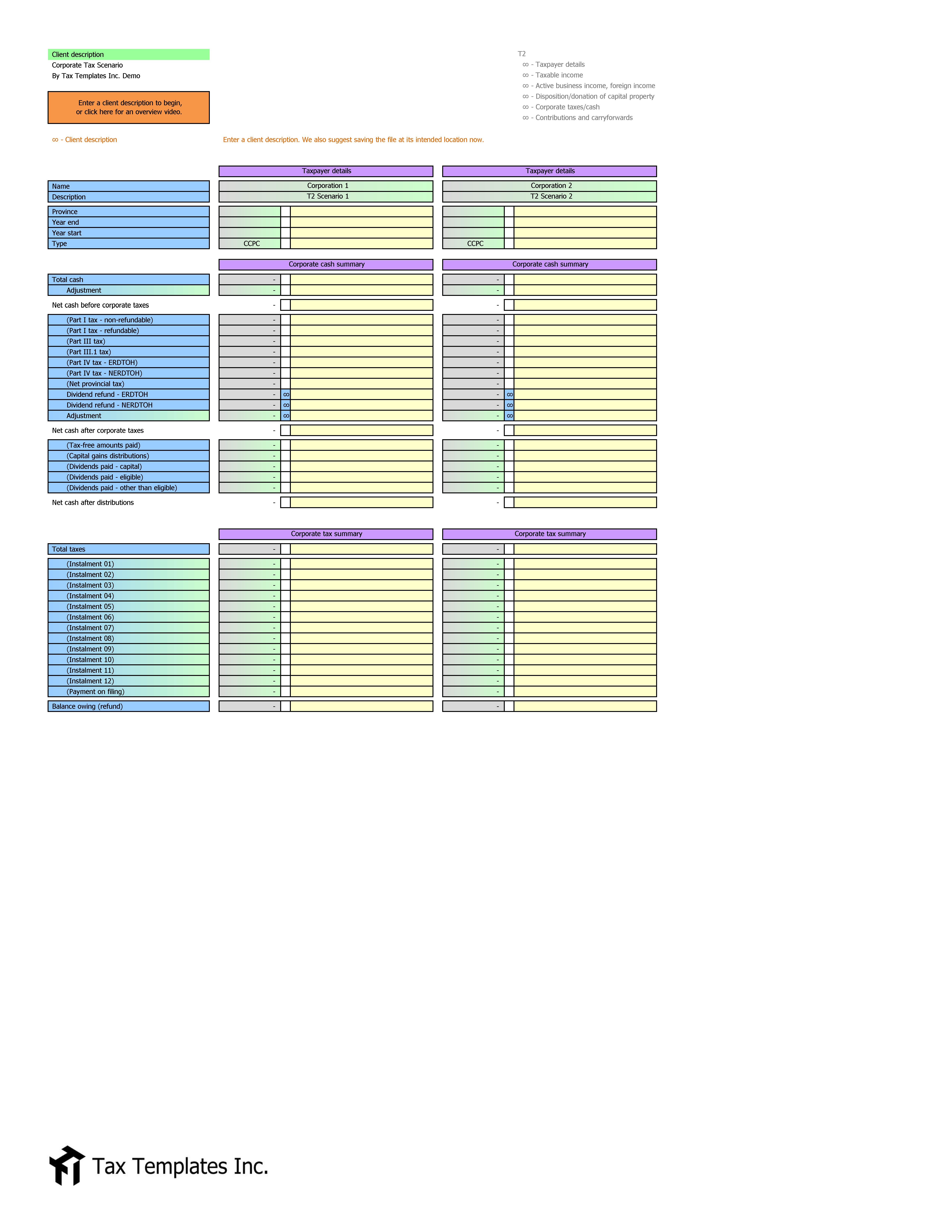

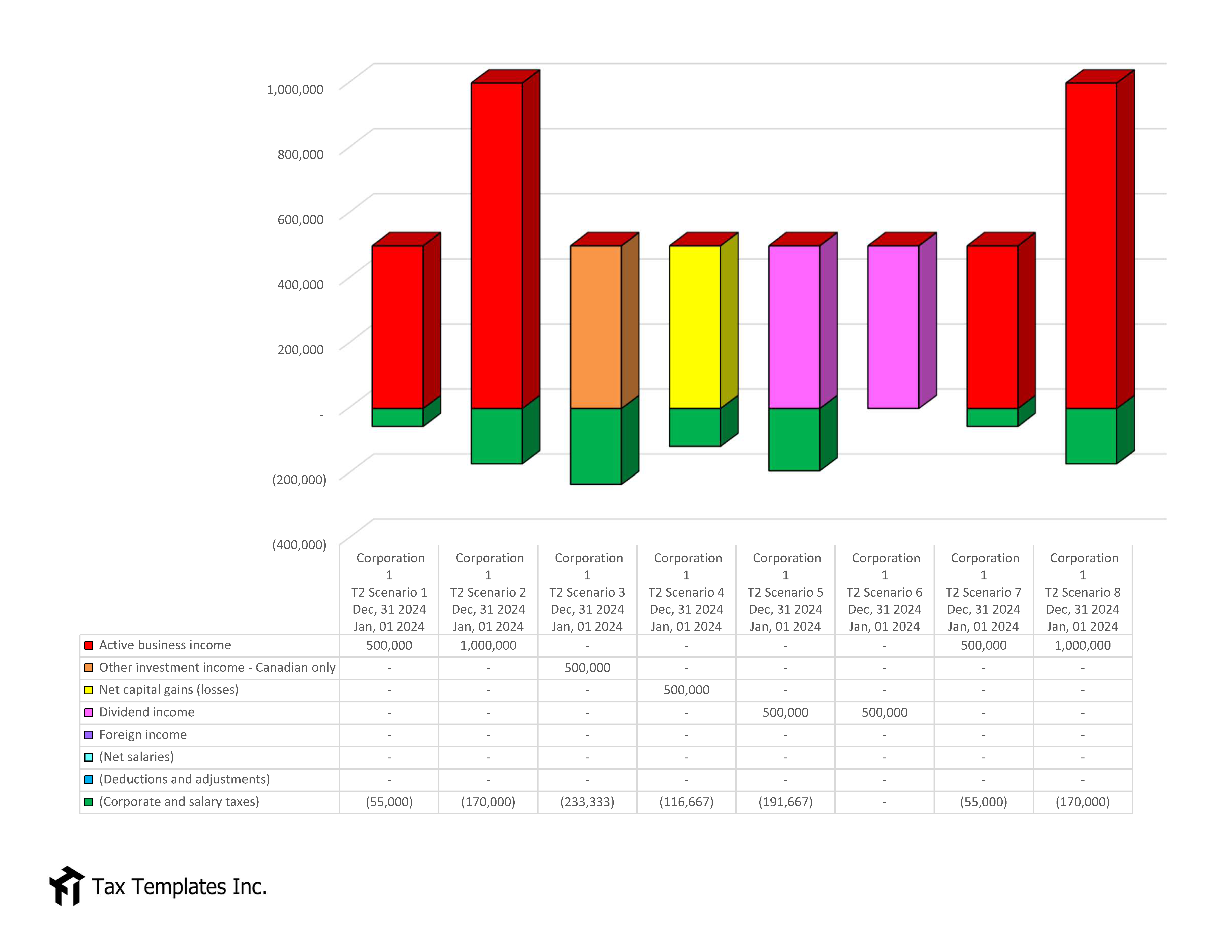

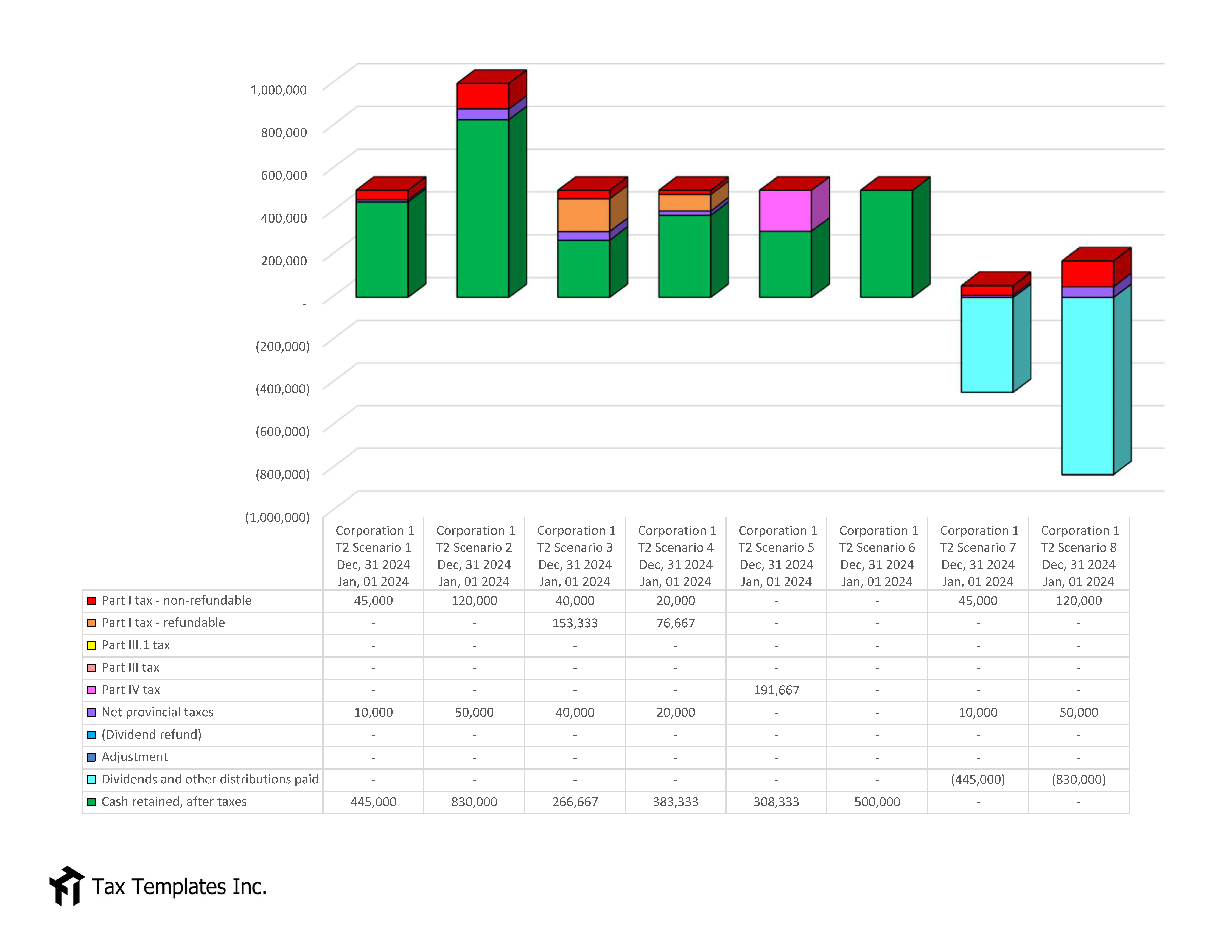

Understand the net cash and tax balances of income and payments

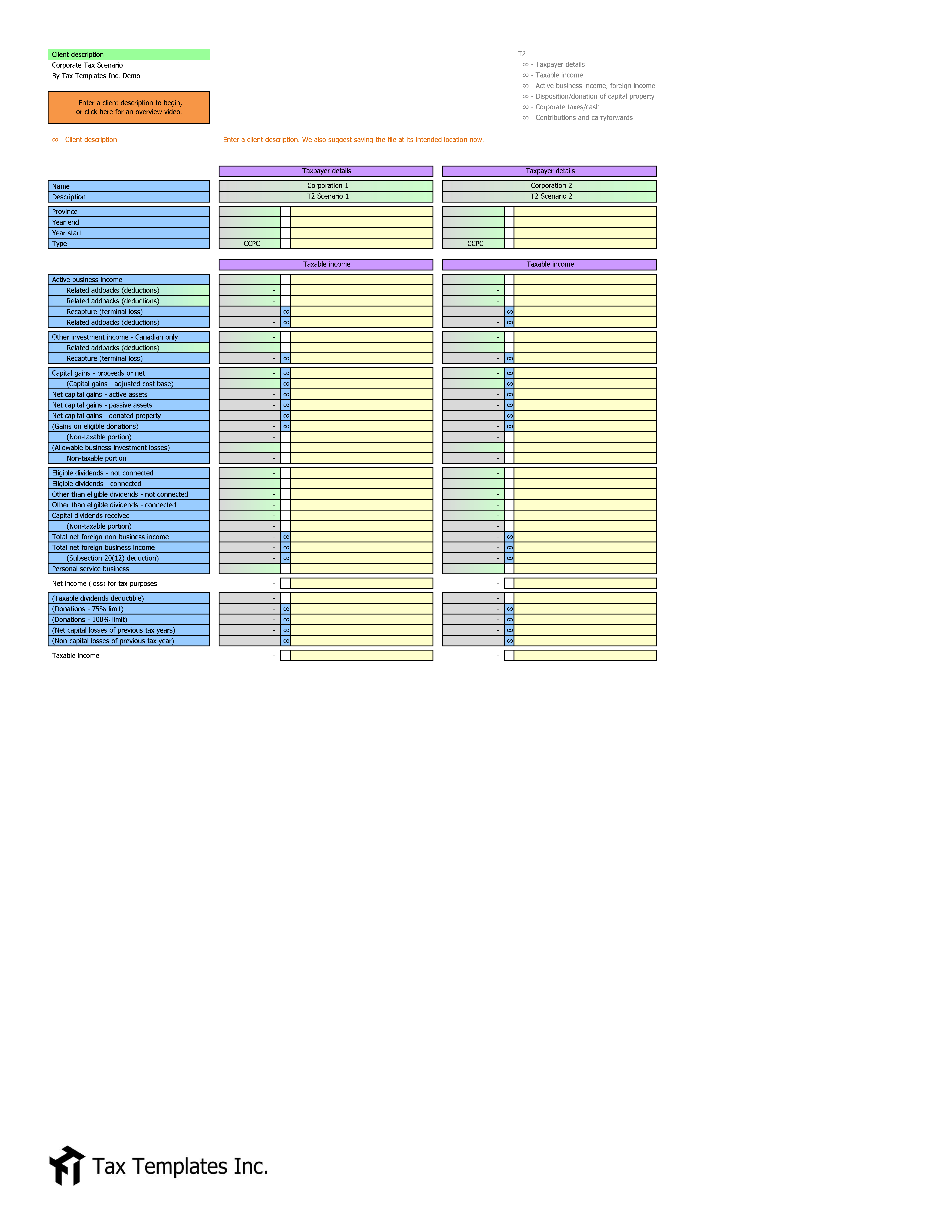

This worksheet projects corporate tax outcomes for CCPCs or other private corporations. This solution has been built for lots of flexibility. You can project up to eight scenarios – either several for one corporation, or a corporate group in one document. You also have the option to easily change between provinces, tax years, or any other variables.

The worksheet supports many key tax balances such as GRIP, NERDTOH, ERDTOH, CDA, AAII, loss carry-forwards, donations, and more for comprehensive results and detailed tax planning.

Other highlights include:

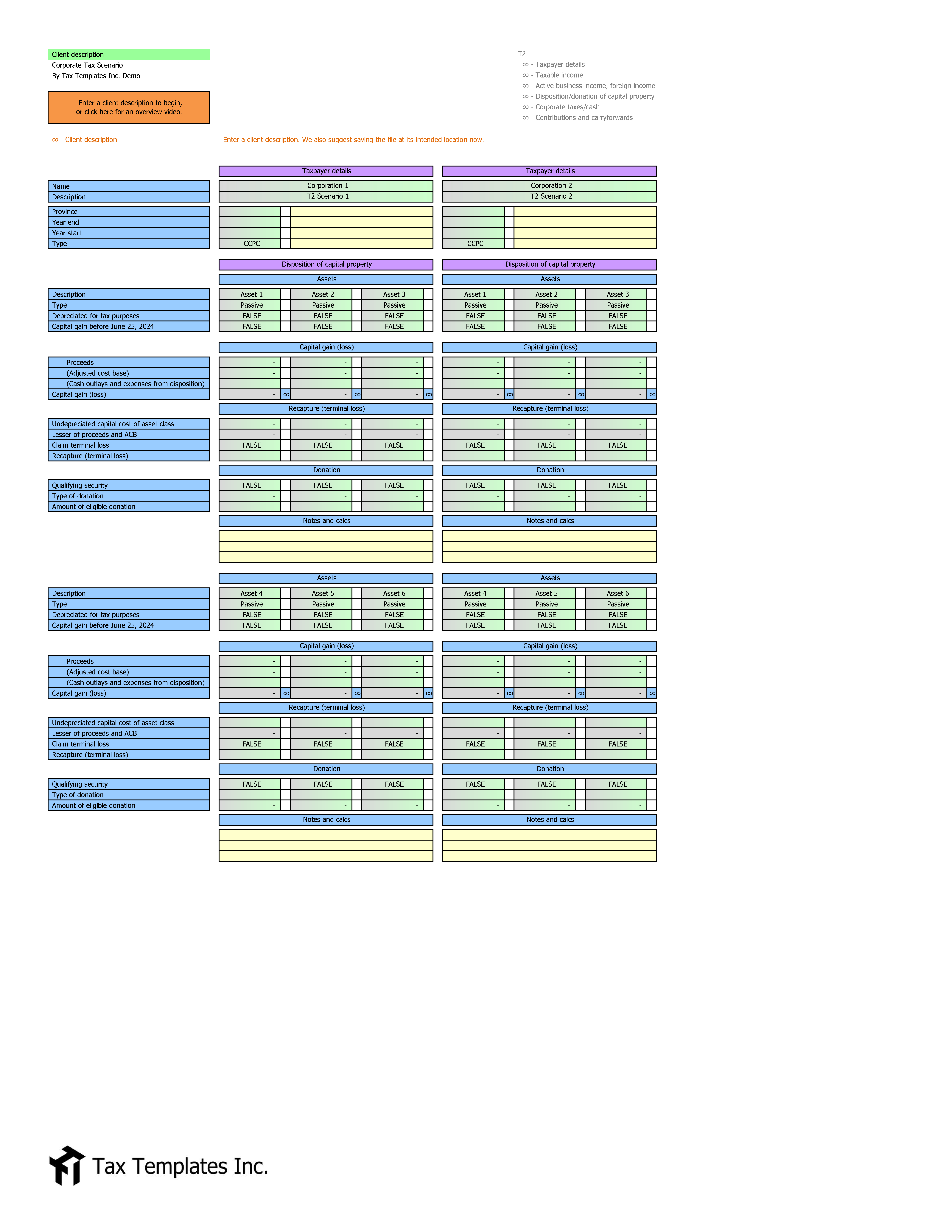

- New 2/3 capital gains inclusion rate effective June 25, 2024 (video)

- Current with all recent Federal and provincial budgets

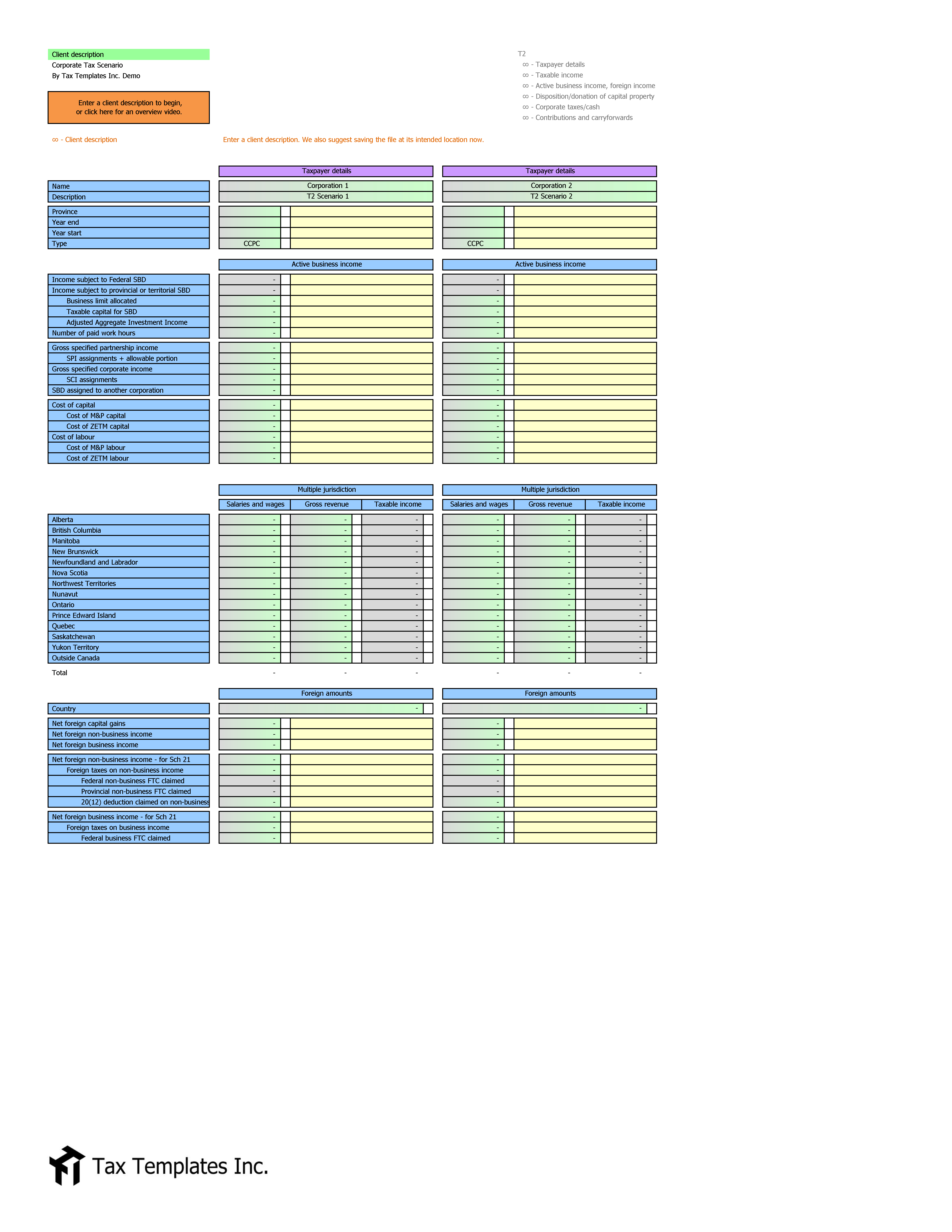

- Multiple jurisdiction supports

- Dividend recommendations based on available balances

- Inter-corporate dividends

- Support for SPI and SCI scenarios

- M&P and ZETM support

- Foreign income calculations

- Installments and balance owing summaries

- Multiple branded charts highlights results

- Written reports to explain scenario outcomes

- Eight side-by-side tax engines

Please review the screenshots/PDF and overview video for more information: